Gerry MacCrossan

Scottish Taxpayers

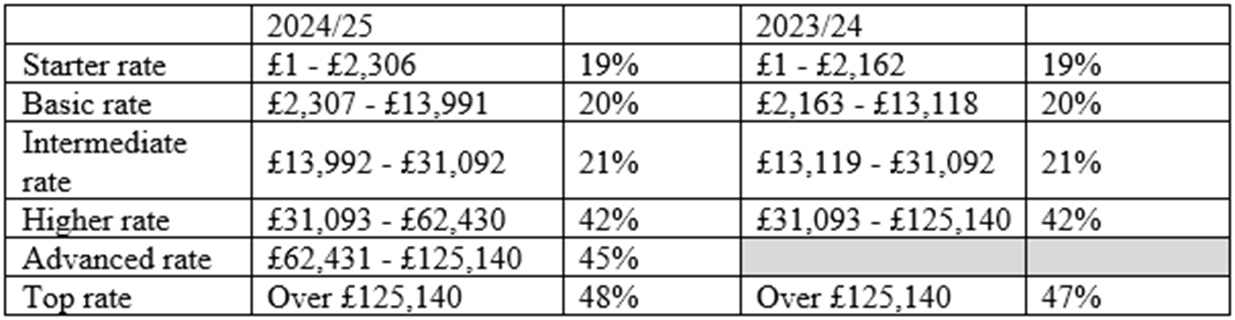

If your main residence is in Scotland or you are otherwise classed as a ‘Scottish taxpayer’, the application of income tax rates and bands applies differently where ‘other income’ is concerned., After the ‘personal allowance’ has been deducted, your ‘other income’ is taxed in bands as follows:

The Scottish Budget was held on 19 December 2023 and made changes including the introduction of the new ‘advanced rate’ of income tax for 2024/25.

Tax on Savings Income

A savings allowance determines how much savings income you can receive at 0% taxation, instead of the usual tax rates for savings income as shown above. This continues to be set at £1,000 for basic rate taxpayers and £500 for higher rate taxpayers. Interest income from an Individual Savings Account (ISA) continues to be exempt from tax.

Tax on Dividend Income

A dividend allowance determines how much dividend income you can receive at 0% taxation, instead of the usual tax rates for dividend income as shown above.

As expected, this allowance will drop to £500 in 2024/25, down from the £1,000 2023/24 allowance. However, dividend income from a ‘stocks and shares’ ISA continues to be exempt from tax.

Individual Savings Accounts (ISAs)

The limit on how much you can save into ISAs (including cash and stocks and shares ISAs) in 2024/25 remains at £20,000 overall. The Chancellor did announce that the government will introduce a new ‘UK ISA’ with an additional allowance of £5,000 a year but this is subject to consultation, and we do not yet have a start date.

The High-Income Child Benefit Charge

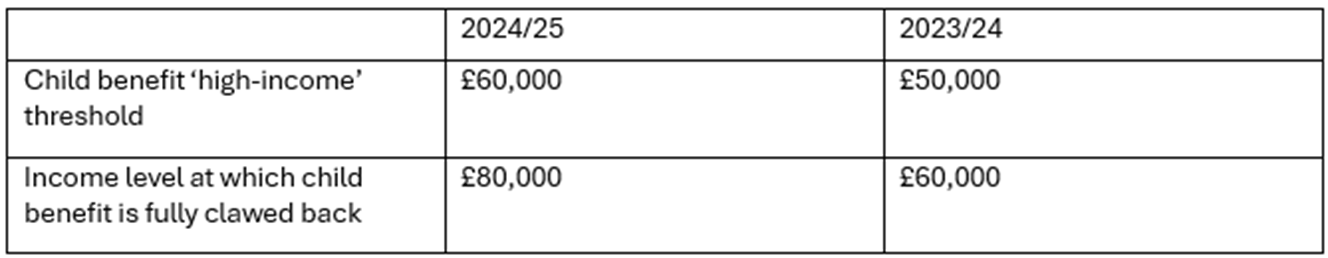

In an effort to reduce unfairness, the thresholds for the high-income child benefit charge (HICBC) will be increased from 2024/25. You may have to pay the HICBC if you are considered to have a ‘high income’ and child benefit is being paid in relation to a child that lives with you, regardless of whether you are a parent of that child. If you are living with another person in a marriage, civil partnership or long-term relationship, you will only be liable to HICBC if you are the higher earner of the two of you.

From 2024/25, the HICBC will be calculated at 1% of the child benefit received for every £200 of income above the threshold. This is a slower rate of clawback than in 2023/24 and now means that child benefit is only fully clawed back where income exceeds £80,000, rather than £60,000 in 2023/24. The HICBC does not apply if the child benefit claimant opts out from receiving the payments.

The Chancellor also announced plans to administer the HICBC based on total household income, rather than the income of the highest earner in the household, by April 2026.

Disregarding for this purpose the other changes announced in the Budget, if we take a couple claiming child benefit in respect of two children and the higher earner earns £70,000, the household will be £1,106 better off than if the threshold had not been increased. If the higher earner instead earns £60,000, the household will be £2,212 better off in 2024/25 and the higher earner will not be required to submit a self-assessment tax return in respect of the HICBC.

EMPLOYMENT TAXES

For Employees

As announced in Autumn Statement 2023 and effective since 6 January 2024, the main rate of Class 1 National Insurance Contributions (NICs) has already reduced from 12% to 10%.

In the Budget, the Chancellor cut this by a further 2 percentage points to 8%, taking effect from 6 April 2024.

For 2024/25, this combined 4% reduction will apply to your annual earnings between £12,570 and £50,270. The NIC rate on your earnings above £50,270 a year remains at 2%.

So what? This combined NIC reduction means that someone with employment income of, say, £50,000 will pay £1,497 fewer NICs in 2024/25 than if the rate had remained at 12%. Or, to look at it another way, their monthly pay packet will increase by almost £125.

For Employers

There have been no changes to the rate or thresholds for employer’s Class 1 NICs, which remains at 13.8% for wages paid more than £9,100 a year (£175 per week). For eligible employers, the employment allowance remains at £5,000 per year, reducing their total employer’s NIC liability by this sum.

Benefits in Kind

Employees are required to pay income tax on certain non-cash benefits. For example, the provision of a company car constitutes a taxable ‘benefit in kind’. Employers also pay Class 1A NIC at 13.8% on the value of benefits.

The set percentages used to calculate company car benefits are fixed until 5 April 2026 before slight increases apply to most car types, including electronic and ultra-low emissions, from 6 April 2026.

The figures used to calculate benefits-in-kind on employer-provided vans, van fuel (for private journeys in company vans), and car fuel (for private journeys in company cars) remain fixed at their 2023/24 levels in 2024/25. These are:

Van benefit £3,960

Van fuel benefit £757

Car fuel benefit multiplier £27,800