Over the next few months, you will be learning more about myself and my colleagues through the theme of eggs! It may sound bizarre, but it will all make sense…

Read moreIn recent years HMRC has identified and successfully challenged several spurious claims for Research and Development (R&D) tax credit relief made by purported ‘R&D Consultants’. Many of these claims have…

Read moreWith the departure of Boris Johnson, the contenders as leader of the Conservative Party and Prime Minister (PM) have now been whittled down to the last two candidates – Rishi…

Read moreMaking Tax Digital (MTD) for VAT has been with us since April 2019, with the extension to all VAT registered businesses from April 2022. The next roll-out will be the…

Read more

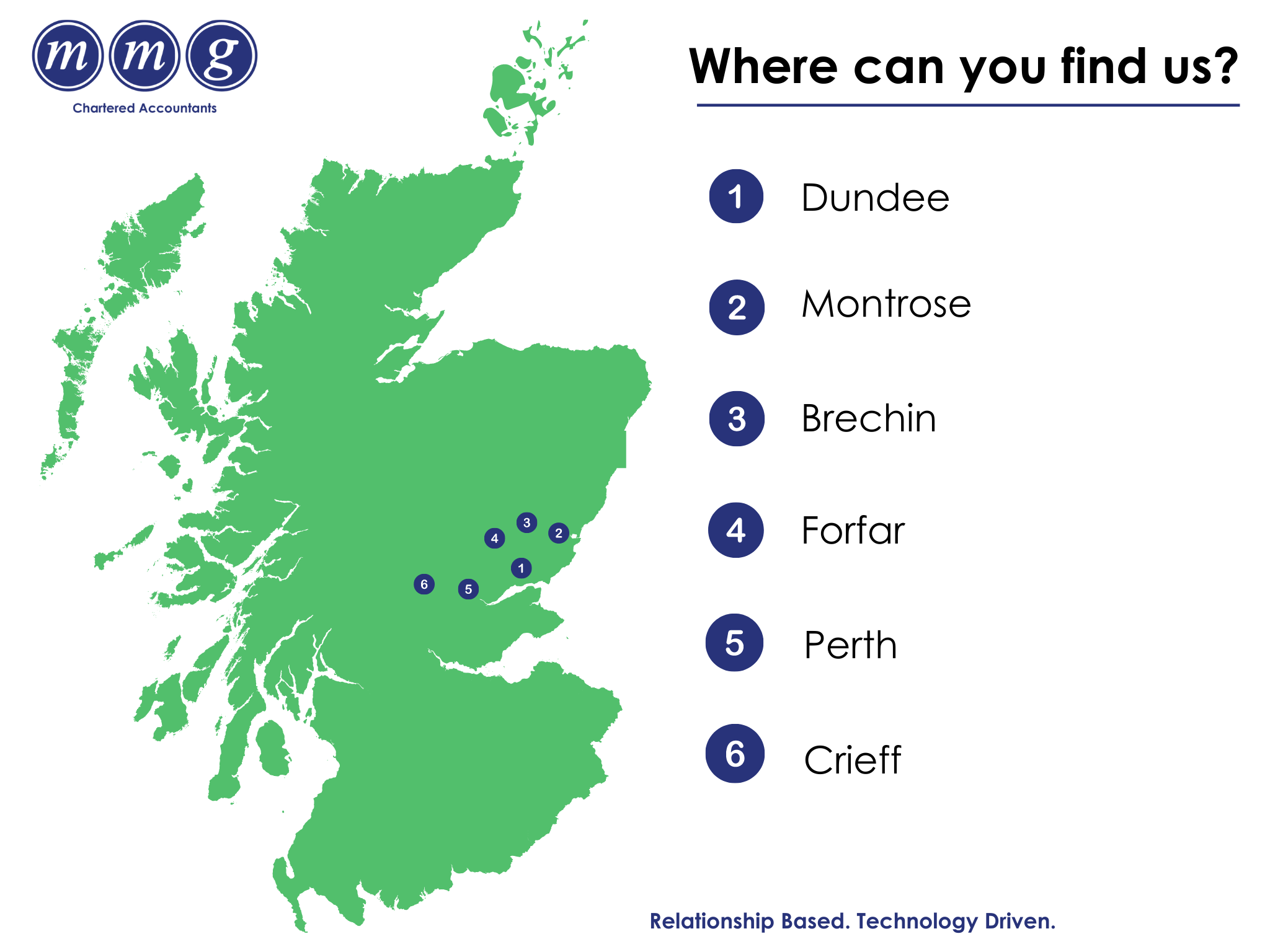

Phew! It’s been quite the year for MMG Chartered Accountants. As you might have heard, we merged with Finlaysons, Tough and Walker Harris through 2021 and rebranded as MMG Chartered…

Read moreHMRC have also issued new guidance on the penalties that they impose for non-compliance with the Making Tax Digital (MTD) for VAT rules. In particular, there is a penalty of…

Read moreThe Research & Development (R&D) tax credit scheme for small and medium-sized enterprise companies is particularly generous as there is currently 230% relief for qualifying expenditure. Where the company is…

Read more

If you have children under the age of 12 who attend after-school clubs, play schemes, childminding or you are considering sending them to a summer camp, you should think about…

Read more