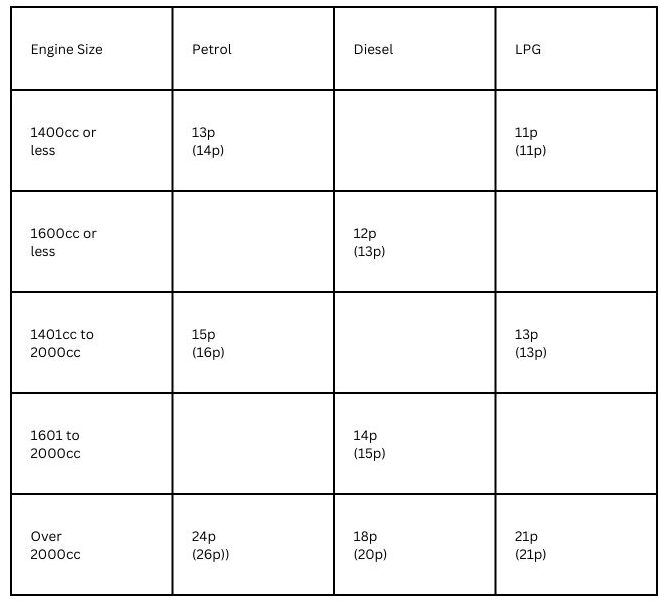

Here are the HMRC advisory fuel rates effective from 1 September 2024. These are the suggested reimbursement rates for employees’ private mileage using their company car (the previous rate is shown in brackets):

You may continue using the old rates for up to 1 month after the new rates come into effect. For hybrid cars, you must use the petrol or diesel rate. For fully electric vehicles, the rate is 7p (previously 9p) per mile.

If the employer does not cover any fuel costs for the company car, these rates can be used to reimburse employees for business journeys without the reimbursement being taxable for the employee.

Input VAT:

- The rates in the table represent the fuel element. Employers can reclaim 20/120 of this amount as input VAT, provided they have a VAT invoice from the filling station. For a 2000cc diesel car, this means 3 pence per mile can be reclaimed as input VAT (18p x 1/6).

Employees Using Their Own Cars:

For employees using their own cars for business use, the Advisory Mileage Allowance Payment (AMAP) tax-free reimbursement rate remains 45p per mile (plus 5p per passenger) for the first 10,000 business miles. After this, the rate drops to 25p per mile. For National Insurance purposes, employers can continue to reimburse at the 45p rate regardless of the 10,000-mile threshold.