Paul Crichton

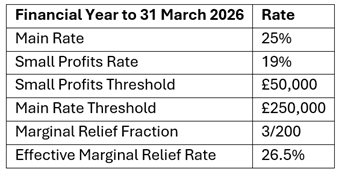

Corporate tax rates from 1 April 2025 for the financial year ending 31 March 2026, corporate tax rates and thresholds will remain:

The thresholds apply across all companies in a group or those controlled by the same person, although dormant associated companies are excluded. Marginal relief will benefit companies with profits between the lower and main rate thresholds, effectively taxing up to £50,000 at 19% and the remaining profit at 26.5%.

Corporate Tax Roadmap

The government’s roadmap for corporate tax aims for stability and includes:

- No increase in corporation tax rates beyond current levels.

- Retention of the annual investment allowance for 100% relief on up to £1 million of qualifying plant and machinery purchases each year.

- Continuing the full-expensing regime for qualifying plant and machinery, allowing either 50% or 100% tax relief on purchases without a limit.

- Maintaining current rates of Research & Development (R&D) reliefs (detailed below).

Research & Development (R&D) Reliefs: Under current R&D relief, most companies can receive a 20% taxable benefit on qualifying R&D expenses. For loss-making R&D-intensive SMEs (where 30% or more of total expenditure is on R&D), there’s an 86% uplift in deductible expenses and a 14.5% payable tax credit. HMRC’s compliance checks on claims have increased, affecting the number of successful claims, so seeking guidance may be beneficial when making a claim.

Annual Tax on Enveloped Dwellings (ATED): Entities holding UK residential properties valued above £500,000 may need to file an ATED return or pay ATED. Rates will increase from 1 April 2025.