Gerry MacCrossan

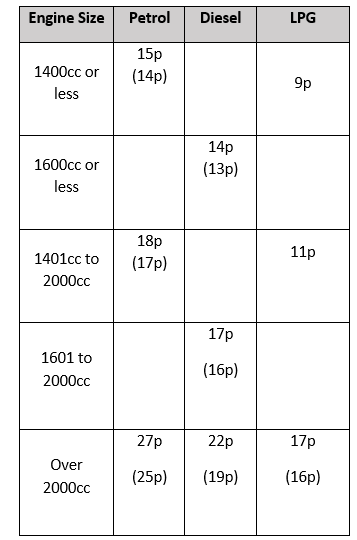

The figures in the table below are the HMRC suggested reimbursement rates for employees’ private mileage using their company car from 1 September 2022. The fuel benefit is not applicable if private fuel has been fully reimbursed.

Where the employer does not pay for any fuel for the company car, these are the amounts that can be reimbursed tax-free for tax-free business journeys. The previous rate is shown in brackets where there has been a change.

Note that for hybrid cars you must use the petrol or diesel rate. You can continue to use the previous rates for up to one month from the date the new rates apply.