Carol Selfridge

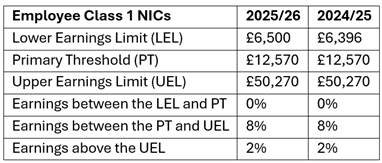

For employees the national insurance rates and thresholds for employees in the 2025/26 tax year are as follows:

Earnings below the LEL do not qualify for National Insurance contributions or state benefits. Earnings between the LEL and PT earn benefit entitlement but remain NIC-exempt.

For employers from 6 April 2025, several changes will impact employer NICs:

- Employers’ NICs rate increases from 13.8% to 15%.

- The salary threshold for NIC contributions drops from £9,100 to £5,000 for most employees (higher thresholds apply for young workers and apprentices).

- The Employment Allowance increases from £5,000 to £10,500, and eligibility is broadened by removing the previous £100,000 employer NIC cap.

These changes, alongside increased minimum wage rates, may pressure wage budgets, impacting growth in employee wages and possibly increasing consumer prices.

Benefits in kind: In 2025/26, employers will pay Class 1A NIC at a new rate of 15% on certain employee benefits, such as company cars. The value of a company car benefit is based on the car’s list price and emissions, with rates increasing annually until 2028. Additionally, benefit values for company-provided vans,

Vehicles such as double cab pickups with a payload of 1 tonne or more but unsuitable for goods carrying will be taxed as cars from 2025, while those ordered before this date can remain taxed as vans until 2029.

Other Updates: The official interest rate on employment-related loans and accommodation benefits will become adjustable every quarter from April 2025. Mandatory digital reporting of benefits through payroll software begins in April 2026, with optional reporting available for employment-related loans and accommodation.